China‘s Ban On Cryptocurrency Was Inevitable

Before we dive in… let’s begin with some pertinent facts.

The Chinese are very skilled in creating cheap energy. Hence why so many Bitcoin miners took massive advantage of China’s ‘cheap energy’ for their ‘energy intensive’ hashing. Bitcoin requires copious amounts of energy for hashing, which is the computational processing power needed to build the blockchain. The more hashing occurs, the more Bitcoin is being mined. And the miners had free reign until China finally cracked the whip on crypto mining. The Chinese government became concerned ‘energy intensive’ hashing would put a strain on the country’s clean energy reserves and overall environmental goals.

Let’s take a look at the timeline of events preceding China’s official ban on cryptocurrency…

2013 – PBOC People’s Bank of China bans handling Bitcoin transactions

2017 – China bans initial coin offerings (ICOs) and crypto exchanges

2019 – China cracks down on crypto mining (taking semi-official action)

Early 2021 – Chinese government bans financial institutions and payment companies from providing crypto-related services

Mid 2021 – China officially bans cryptocurrency transactions & exchanges

9/24/2021- Cryptocurrency transactions and mining are now illegal in China

There are certainly wide gaps in this timeline. While trading cryptocurrency has been non-officially banned in China since 2019, Chinese citizens circumvented the initial ban by using offshore exchanges and peer-to-peer trading. Effective September 24th, 2021 – any cryptocurrency exchanges, transactions or mining are now illegal in China.

Cryptocurrency Mining Flux

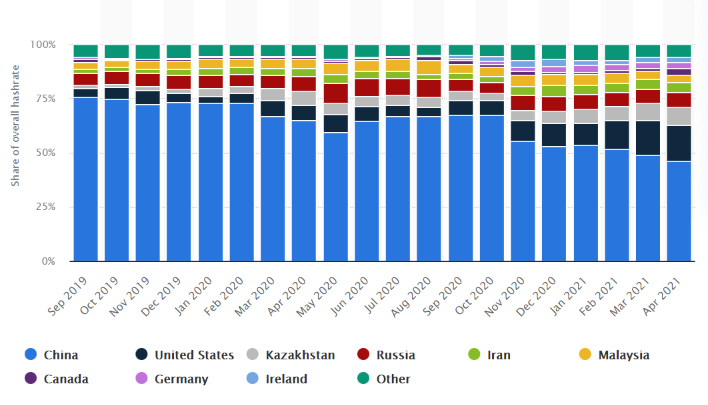

In the wake of China’s pre-emptive bans and more recent criminalization of cryptocurrency mining- the share of overall global hashrate is in flux. The percentage of miners in China dropped from roughly 65% (September 2020) to about 46% (September 2021). Check out the stats…

Global Hashrate Distribution

Where Did All The Crypto Miners Go?

46.04% China

16.85% USA

8.9% Kazakhstan

6.84% Russia

4.46% Iran

3.44% Malaysia

3% Canada

2.81% Germany

2.27% Ireland

5.92% Other

Will China Try To Kill Bitcoin?

Let’s face it, China’s not exactly a friend of the United States nor are they an enemy. What’s significant, there’s opportunistic trading motives for China to cooperate with the United States. Although, China’s always on guard and intends to have surreptitious ways for dealing with confrontation. In other words, ways of hurting the United States that wouldn’t evoke war but would be catastrophic for the world. Everybody loses in that kind of scenario and Bitcoin could be the ammunition they’re looking for.

There’s a lot of good things you could say about Bitcoin. It’s blockchain is secure and it’s something that cannot be hacked. It also qualifies as a currency in many ways except Bitcoin can be counterfeit under the conditions of what they call a ‘double spend.’ To put it simply, it’s the same thing as taking counterfeit paper money and spending it wherever you want. A ‘double spend’ can occur when a counterfeit Bitcoin is used for multiple transactions using the exact same Bitcoin.

How does this happen? There’s only one condition that would allow that kind of situation to occur. And that’s a condition where the majority of Bitcoin miners agree to act simultaneously to flood the market with counterfeit Bitcoin. A majority of the Bitcoin miners are sitting in China and the rest are located in China-friendly countries such as Russia or Iran. These countries don’t particularly like the USA. Who knows, they might be plotting to do something to hurt dollar-based currencies. Ironically enough, taking down Bitcoin would be a clever way to do so. The effects on China would be indirect, however it would cause reverberations across the financial world.

When these cryptocurrencies start imploding- and it’s very likely that they will- then you have the making of a real economic catastrophe.

I’m not insinuating that China’s planning to do this but if Bitcoin gets in the way of their own digital currency, almost surely they will do something to stomp it out. That’s not a good situation for investors to be in… especially if Bitcoin goes up to $100k. Likewise, if the capitalization of Bitcoin doubles and the market cap rises from $2 trillion up to $4 trillion, suddenly you have an entire infrastructure that you’re developing around Bitcoin.

It’s not a matter of if… it’s a matter of when.

At some point, I believe China will set its sights to eliminate Bitcoin and other cryptocurrencies that may compete with the digital yuan. Right now, if you’re an investor buying Bitcoin, you better hope that China’s not planning to do something precipitous. Because when China decides they don’t want Bitcoin around anymore; they’re going in for the kill.

As an investor, if you’re comfortable investing under those circumstances, go for it! I’m certainly not comfortable investing in Bitcoin under those conditions. I strongly anticipate that eventually Bitcoin will end up at zero. How do I come to this conclusion? It highly resembles the Dot.com bubble that we saw in the early 2000s – where investors made between five to ten fold on their investment very quickly on stocks from companies that ended up bankrupt.