Investment Opportunities For Every American

November 7 (King World News) – Dr. Stephen Leeb:

In past periods of turmoil, history has often been a useful guide, pointing to what we can expect from financial markets. But today, historical parallels are less useful, because the current period bears little resemblance to anything we’ve seen before.

The 1987 market crash could be seen as more similar to 1962 than to 1929, because in 1987 and 1962, in contrast to 1929, the FED and the federal government were in a position to play a proactive role and staunch the damage. That provided a strong clue in 1987 that a major economic setback was unlikely and that investors were staring at a great buying opportunity. History proved its worth.

Great Opportunity From The Stagflation Of The 1970s

In the late 1970s and early 1980s, Paul Volcker’s war on inflation suggested a recession was imminent and a bear market likely. That was because rising interest rates had preceded other bear markets in the postwar period. Savvy investors such as Peter Lynch went even further. He reasoned that if investors realized that the tumultuous economy that Volcker created would succeed in leading to lower inflation, P/Es would rise. Thus, Lynch used the stomach-churning volatility of the 1980-82 period to gobble up small-cap stocks whose P/Es had shriveled in the stagflation of the 1970s. Lynch’s historical insights launched Fidelity into the highest tiers of investment management. For that matter even the first bear market of the new century – the tech bubble – had plenty of historical parallels. Though the tech bubble was larger than the airline and casino bubbles in the 1970’s, shrewd investors were well aware of the consequences of bubbles.

But since then, it has been harder to find historical analogies to this century’s great traumas, including 9/11 and the Covid pandemic. And history is likely to continue to be less useful than in the past. That’s because there’s a fundamental difference between the 21st current century and the 20th century, one that makes that earlier century not particularly relevant to today. So anyone trying, for instance, to make sense of today’s inflation by comparing it to the 1970s or to the inflation that accompanied WWII and its aftermath is likely to be led astray…

Getting Rich In The Process

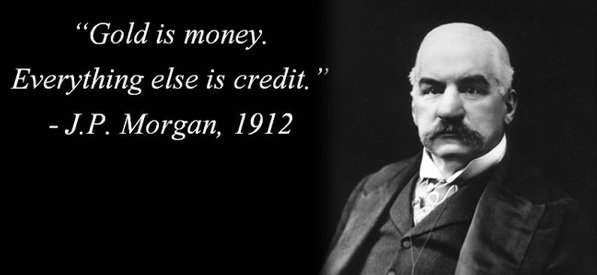

What has changed? It’s that the U.S., while still a mighty power, is no longer the clear No. 1. We’re no longer master of our own destiny. This makes it necessary to view history from a broader and longer perspective, and doing so points to major changes afoot. For investors, I believe the most important consequence will be a new reserve currency. That in turn means that for the foreseeable future, gold along with silver and other commodities will be the only way to protect yourself – and to get rich in the process.

It’s worth looking back at those earlier periods of inflation to see in more detail what has changed. The inflation during WWII resulted from massive spending, which created massive government debt. With interest rates fixed at low levels by the government, negative rates acted as a sort of tax on Americans. That may sound like today. The difference is that in WWII’s aftermath, we were the only man standing, and brother did we stand tall. We dominated the world in every possible way.

Perhaps most important was that we had a reservoir of great technologies, some developed in the 1930s and some that stemmed from our having created an unparalleled war machine. After the war, pent-up consumer demand led to strong productivity growth that produced more than a generation of rising incomes for all.

Some analysts have argued that, similar to the WWII era, today’s negative rates serve as a tax on Americans that can help finance the burgeoning public debt. But the comparison doesn’t work, for several reasons. After the war, we had a highly progressive tax structure in which marginal rates were in the low 90s, making it possible to pay down the debt. Relatively high taxes and an economic boom worked magic. Government spending also fell dramatically in the war’s aftermath. No surprise, then, that government debt tumbled.

Gold-Backed US Dollar Ruled The World

Also very important, the country was united back then, while today we are more polarized than at any time in memory. Yet another difference is that back then we were rich not just financially but also in terms of real resources. That our gold-backed dollar served as the world’s reserve currency further cemented our unmatched hegemony.

Moving ahead to the 1970s, the defining moment of that decade came in 1971, when we ditched the gold standard. In retrospect, that spelled the end of America’s steady rise and the start of what has been a long decline. But still, for a long time, the U.S. maintained more than enough strength to dominate.

Inflation, which had started to rise in the mid to late 1960s, was artificially depressed by wage and price controls after we abandoned the dollar-gold link. Then OPEC, motivated in part by rising U.S. inflation, embargoed oil at the end of 1973. Oil prices shot up about fourfold, and inflation took hold. But our economic, military, and technological superiority enabled us to enter into a bargain with the Saudis in which we would protect their country and assure safe passage for their oil in return for their agreeing to price oil in dollars. It is fair to say Nixon and his negotiating team were in a position to make the kind of offer the Saudis could not refuse. Thus was the petrodollar born, ensuring the dollar would hold onto its position as the world’s reserve currency, and in this case there were none of those nasty strings that gold imposed.

And today? We have practically been begging the Saudis to pump more oil, and so far to no avail. I’m convinced it’s just a matter of time before the petrodollar goes the way of the dodo. It would not surprise me one bit if some oil contracts between the Saudis and China were priced in yuan.

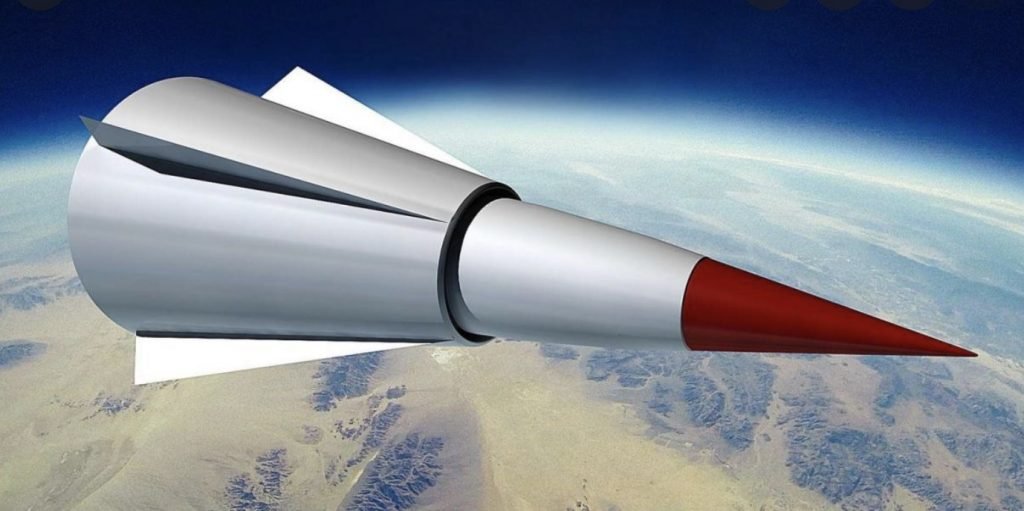

A Sputnik Moment

Another change: our once-unquestioned military superiority no longer is so unquestioned. In prior times our military, backed by exceptional technology, could impose any agreement we wanted. Now our position has weakened. In just the past couple of weeks China sent a clear message not to mess with them, a message in the form of a hypersonic missile, one that’s capable of carrying a nuclear payload and that circled the globe and landed within 20 miles of its target. Given that hypersonic missiles are almost impossible to counter, the chairman of the Joint Chief of Staff called the event a Sputnik moment.

Unfortunately, however, a Sputnik moment, to ignite a response, requires a unified country, something we sadly lack. The highly uncomfortable reality is that if China wanted to invade Taiwan, we’d have no way to stop them other than with the kind of massive reaction that would risk humanity’s future.

One other critical difference between the 1970s and today is that back then, rising commodity prices resulted from a political event, i.e., the OPEC embargo. Today we are facing real resource scarcities without any realistic plan for dealing with them. Indeed, as I have pointed out before, our green agenda is exacerbating these shortages.

Gold’s Rise

The one thing that seems certain is that the current turmoil will lead to major geopolitical changes. The U.S. will be able to have a say in how these develop, but we won’t be able to dictate the outcome. I must emphasize that one change I remain convinced will occur is a new reserve currency that will go hand in hand with a much more prominent role for gold.

As I’ve said before, it won’t be the old gold standard but rather one in which the price of gold will be tied to a group of currencies and allowed to float. That mechanism is what will ensure a dramatic increase in gold’s price as well as in prices of other commodities. But at the same time it will impose discipline on all players in the world’s economy.

But thinking about it a bit more, maybe history is not completely irrelevant to today. The long stretch between 1870 and 2014 was arguably the greatest ever for developed and developing countries alike, given that the U.S., during the initial part of those years, was still a developing economy. There were times when deflation – which today is considered a synonym for depression – was actually just fine, because it came about as a result of major gains in productivity that led to declining prices in the context of surging growth. In other words that period is about as close as you come to economic perfection. And oh yes, that nearly half century following the Civil War was one in which gold was critical to the world’s monetary system.

The Golden Years

If there is a rival for the perfect economy, it would be the years between the end of WWII and 1971, which again were years in which gold was critical to our monetary system. Many would argue that the gold standard was doomed before its official demise. During the 1960s and especially the late 1960s, it was, as the phrase went, guns and butter, with the U.S. fighting a costly war in Vietnam at the same time it was spending a ton of money on domestic programs – after all, there were elections to win. Fed chair Arthur Burns proved that the putative independence of the FED was a mirage as he went along with Nixon’s dictates. In the world’s most powerful country, no one wanted to impose limits or even thought they were needed.

One purpose of backing up a currency or a currency basket with gold is to ensure that countries maintain some discipline and make choices, rather than thinking they can have it all and the future will take care of itself. The lesson from history is that if any single country is so powerful relative to the rest of the world and decides to display that power by ignoring the monetary consequences of its actions, by definition a gold standard or any other putative authority can stop them. And for more than a generation, the U.S. had enough power to consistently flout the need for discipline.

This long period in the U.S. of anything goes is evident not just in government debt levels but also in corporate debt, which stands at close to record levels. It is wild but true that a great deal of that debt was created to give money to shareholders in the form of share buybacks. But those shareholders by and large represent the upper tier of America’s wealth. Consumer debt is also at record levels – and in this case much of the borrowing is out of necessity. One sad fact is that when discipline went out the window, those at the upper tier who controlled the purse strings were not very generous in sharing what they printed with the less fortunate. Most of today’s pervasive debt is held by those that can continue to create ever more rather than paying it back. The bag holders are the growing number of less fortunate Americans who struggle not only with their own high debt levels but with interest rates on their debt many times higher than those facing the creators of the debt.

And I’m not saying that today’s financiers and corporate executives are inherently malevolent. It’s simply an unfortunate part of human nature that if you create a situation in which there are no limits and no immediate consequences to any behavior, people will grab what they can, and you will end up in a mess. And that is exactly what has happened to America. It is a form of how power corrupts. Had America been a bit less powerful in the postwar period, maybe we also would have been more cautious. It might have been guns or butter as we accepted the discipline of a gold standard. It is mind-blowing to think of what we could have achieved if even a modified form of the gold standard had remained in place.

The Bizarro World

For many reasons, we wouldn’t want to live under the kind of authoritarian system that exists in China. Still, years from now the history books may conclude that the U.S. was lucky the Chinese came along when they did, as in the end China may be responsible for saving America from itself. The jolt I am expecting from the East will likely initially be painful. But in the long run it might restore us to our better selves. Meanwhile, buckle up and cushion the near-term jolts with as much gold and other commodities as you can.