Virtually every country today has its own currency. The soundness of each currency and how well it’s accepted, largely depends on the policies of each government. The sharp decline in value of the British pound in 1992, the Mexican peso in 1994, and the German mark in the 1920s are painful reminders that fiat currency (paper money) meltdowns certainly do occur.

However, there is one form of money that you can always trust; gold.

Humanity has witnessed empires rise and fall. Wars and plagues have ravaged civilizations since time immemorial. Inflation has crippled societies. All the while, gold has always held its real value.

Those who understood the economic necessity of having gold were always able to afford life’s basic necessities of food, clothing and shelter, not to mention life’s simple pleasures- regardless of the turmoil going on around them.

The lesson of gold’s reliance is well known to most of the world burdened by tyrannical and confiscatory governments for centuries. Asians and Middle Easterners, in particular, are famous for using the metal as a store of wealth.

Americans- on the other hand- view gold as a speculative investment soaring at certain times before plunging back to Earth.

Moving forward into the next decade, gold will once again glitter for its speculative appeal; it will also prove to be a great store of value protecting its owners against inflation. During the inflationary period of the 1970s, gold rose from its controlled price of $35 per ounce in the early decade up to $800 in 1980.

Noble Gold

Why does gold hold its ground so well in almost any economic and political environment?

Because it’s the most noble of all metals!

And that’s not a phrase from a ‘hard money’ handbook or survivalist mantra!

Gold has utterly unique properties. Simply, no metal is more beautiful or has more resistance to corrosion than gold.

Gold’s noble character has given it a unique ability to hold its value no matter what the economic environment.

Let’s take a look back over any fairly long stretch of time. In the early 1930s, gold was fixed at a price of $35 an ounce. By the mid-1990s, the metal was selling for about $380 an ounce. That eleven-fold gain in pricing roughly matched the inflation rate over those 60-plus years.

Turning back time a bit further… Let’s paraphrase a couple of old proverbs; the relationship between gold and bread prices has been constant over the ages. An ounce of gold will buy a nice suit today, just as it did in ancient Egypt and Sumer.

Gold’s ability to hold its value has given it a unique appeal for centuries. Eastern societies have revered gold almost as long as there have been civilizations; they’ve used gold as a way to store, transport and hide wealth from tyrannical rulers.

Present day, over 45% of the world’s gold is held by central banks as a reserve asset. Central bankers know that unlike any other currency gold is money that will be accepted everywhere, anytime.

How has gold managed to maintain value throughout history?

Well, it’s also peculiar in another respect. Despite all those marvelous aforementioned properties, the metal has very few industrial or medical uses. And even if it does, there are cheaper substitutes.

For example, gold is a great conductor of electricity but other metals like copper perform the same functionality at a far lower cost. The lack of industrial uses for gold means that no scientific development has or ever will replace it.

Gold’s value instead comes from unique, intrinsic properties that are valued for their own sake; such as beauty, flexibility and resilience. Those are irreplaceable.

Gold As Money

Gold’s timeless value made it the mainstay of all major world economies from the early 1700s until the Great Depression of the 1930s. The US dollar was pegged to the metal until the early 1970s. Except for times of war, governments guaranteed the value of their currencies by pledging to exchange a set amount of gold for paper money. This system was known as the infamous gold standard.

Under the gold standard, the amount of gold in a country’s treasury had a major influence on its economic activity. In the United States- every dollar printed had to be backed by a certain amount of gold. If foreigners wanted to exchange their paper currency for gold… The central banks were required to physically deliver it.

This strategy would put the brakes on inflation and slow the outflow of gold. However it sometimes had the unfortunate side effect of turning economic turndowns into full-scale recessions.

As Charles Kindleberger points out in his book The World in Depression, during the early 1930s the threat of gold outflows forced central banks to keep credit tight even as their economies entered the Great Depression. More than anything else it was the massive unemployment and sluggish growth of the 1930s that ended the gold standard for most of the world’s economies.

Following WWII, Economic Ministers of the victorious democracies established the Bretton Woods Agreement; a currency system named after the site of their conference in New Hampshire. At the time, with Europe in ruins, the American economy was by far the world’s most powerful.

Consequently, under the Bretton Woods system- all of the world’s major currencies were pegged to the US dollar– which represented an ounce of gold valued at $35. All the world’s central banks were required to maintain a reserve of dollars and exchange them for their own currencies. In fact, the United States was not exempt from this requirement- as it was also required to exchange its dollars for gold.

The modified gold standard worked well, so long as America’s economic hegemony was absolute. But as the European and Japanese economies recovered and grew after WWII… It became increasingly harder for the United States to carry the burden of global fiscal responsibility.

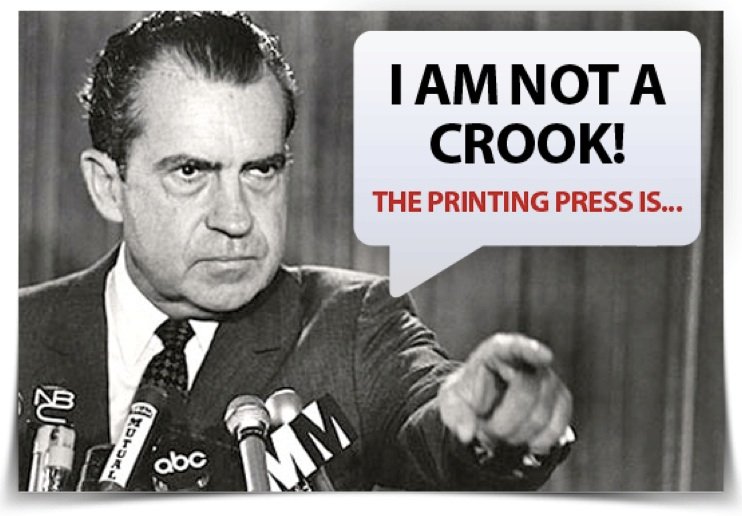

Finally, it all came crashing down in 1971. Fueled by accelerating inflation, the widening trade deficit and a huge run on US gold reserves forced (then-President Nixon) to abandon the convertibility of dollars to gold.

The price of gold was then decontrolled and American citizens were allowed to buy it for the first time since the 1930s. To this day, the spot price of gold per ounce has been largely controlled by the open market.

We doubt the gold standard will be restored anytime soon, even if inflation soars in the decade ahead. The main reason- any attempt to move in that direction would require central banks to give up any control they now exercise over economic growth.

Also, by requiring interest rate hikes to counter gold outflows, a gold standard would prevent the kind of inflationary policies that politicians desperately need to win re-elections, in effort to overcome the effects of declining living standards in the years ahead.

Whether or not the gold standard returns- gold will continue to keep pace with inflation. It’s the only monetary asset that governments cannot create or destroy no matter how inflationary their policies become. Likewise, the metal tends to retain its value during inflationary times. The higher inflation goes, the higher gold prices will go.

And that’s why gold is a core investment for the next decade while inflation reigns supreme.